GAP Insurance

GAP Insurance: A Win-Win for Dealers and Customers

Why Dealers Should Offer GAP Insurance

1. Increased Revenue

GAP insurance is a high-margin F&I (Finance & Insurance) product. It’s an easy upsell that adds to your bottom line without needing extra inventory.

2. Builds Customer Trust

Offering meaningful protection shows that you care about the customer’s long-term financial wellbeing. This improves customer satisfaction and loyalty.

3. Competitive Advantage

Not every dealership actively promotes GAP insurance. Making it part of your sales process positions your dealership as professional and comprehensive.

4. Low Risk, High Reward

There’s minimal overhead in offering GAP coverage — and a strong upside in profits and customer satisfaction.

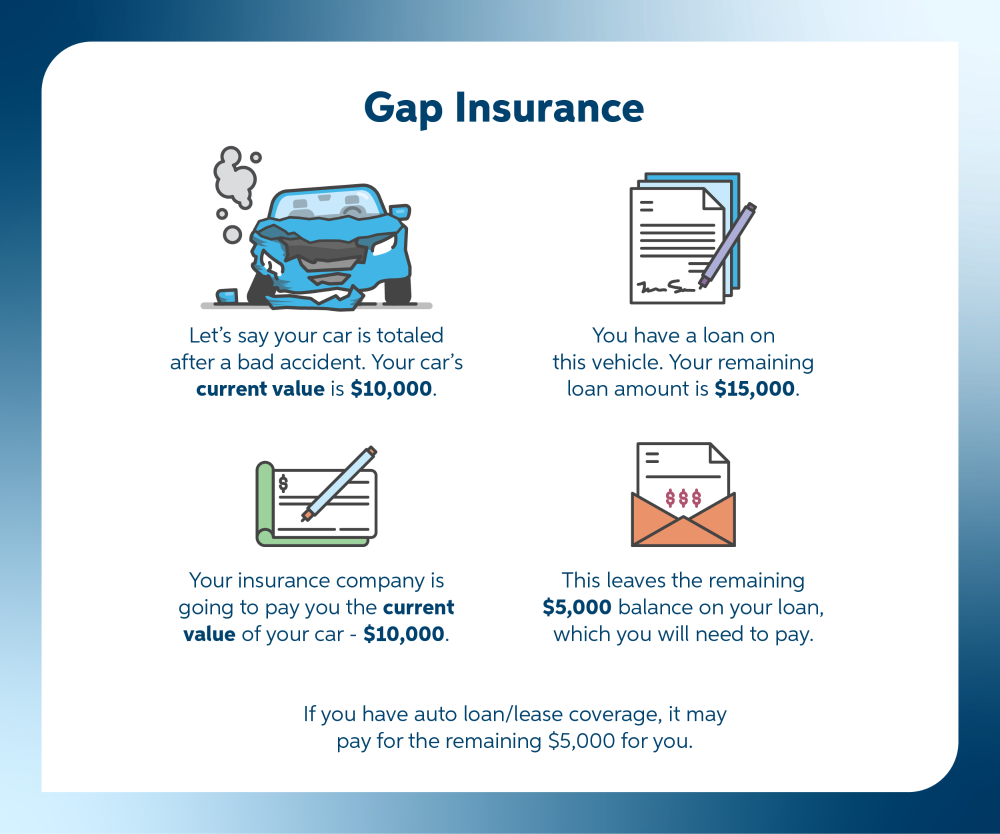

Why Customers Need GAP Insurance

GAP Insurance isn’t just a smart move for your customers — it’s a smart business move for your dealership. By including it in your offerings, you’re protecting your customers and boosting your bottom line.

GAP insurance is a high-margin F&I (Finance & Insurance) product. It’s an easy upsell that adds to your bottom line without needing extra inventory.

Offering meaningful protection shows that you care about the customer's long-term financial wellbeing. This improves customer satisfaction and loyalty.

Not every dealership actively promotes GAP insurance. Making it part of your sales process positions your dealership as professional and comprehensive.